Part time income calculator

You should then print out the summary and include it as part of the beneficiarys file. Taking a part-time job to supplement your normal salary is an even better way to increase your income and the prospect of finding a part-time position in your field is excellent.

17 An Hour Is How Much A Year Can I Live On It Money Bliss

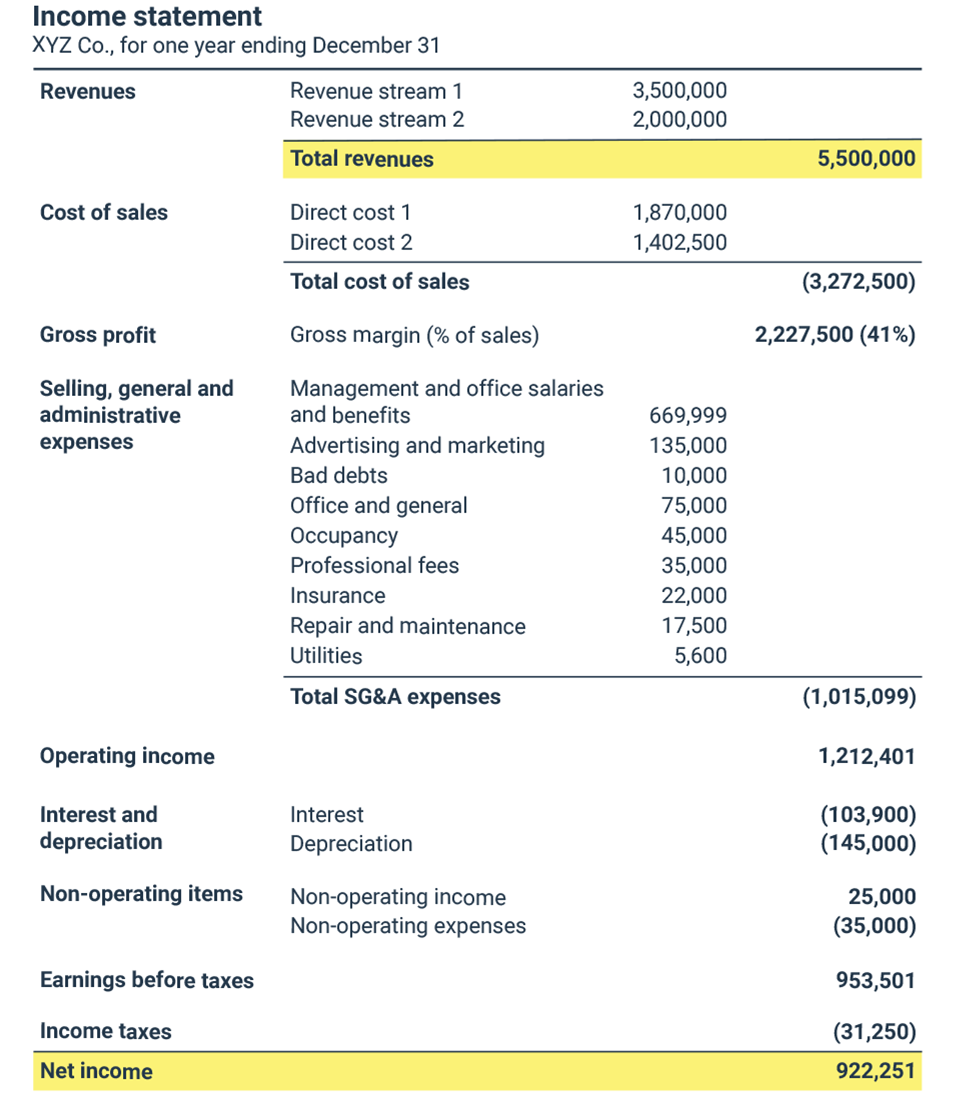

Analysts often use a variant of the above calculation in which net income is used in place of revenue in the numerator.

. They hire part-time merchandisers to replenish displays order stock and set up promotions. For example if the rent is 500month and the renter earns 2000month their rent to income ratio would be 25. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The rent-to-income ratio is a formula used to measure a renters ability to pay rent and is calculated by dividing rent by the renters income stated as a percentage. If you choose to file a paper return you can use. If your personal or financial situation changes for 2022 for example your job starts in summer 2021 and continues for all of 2022 or your part-time job becomes full-time you are encouraged to come back in early 2022 and use the calculator again.

Missouri offers the following filing options. The Aid for Part-time Study APTS program provides grant assistance for eligible part-time students enrolled in approved undergraduate studies. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind.

Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. Marios management assigns him the. Optional new tax regime No change in the existing tax slab rates but a new tax regime has been proposed.

The income tax calculator for Sweden allows you to select the number of payroll payments you receive in a year this could be 12 1 a month 13 with bonus 14 with additional payments or more you can choose the number of payroll payments in the year to produce an annual income tax calculation. Paper Long Form - MO-1040. No the calculator assumes you will have the job for the same length of time in 2022.

Paper Short Forms - MO-1040A. No matter what method you choose your 2021 income tax return is due April 18 2022. The income values for each tax bracket are shifted slightly depending on your filing status.

Well ignore the Optional Settings on the right for the time being. The income tax applies to wages salaries commissions allowances fees bonuses and any other income for which the employer is chargeable by the employee for services provided. Helping you better invest your time and money with online resources in personal finance.

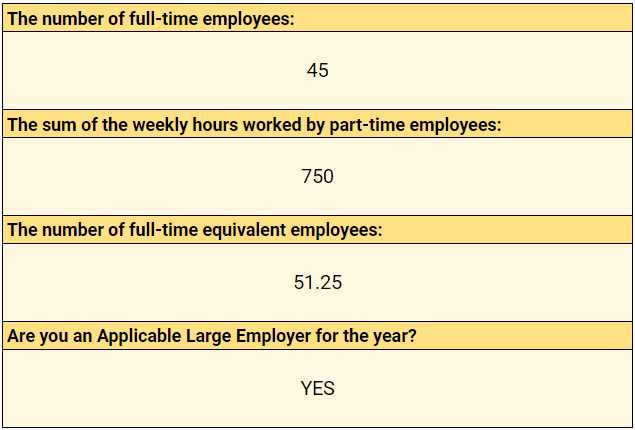

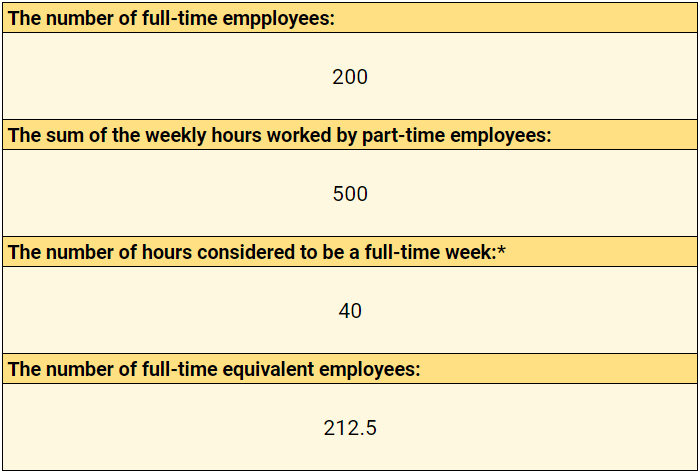

FTE Calculator - Companys Full-Time Equivalent. Changes in FY 2020-21 Budget Feb 2020. The personal income tax system in Ireland is a progressive tax system.

Heres a list of eligible sources of additional income. Payment from part-time work. Updates and News Update.

Find out if youre in the 1 to see where you stand today or to see where you project yourself to be in the future. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. Electronic Filing e-filing of your state and federal return.

Tax rates range from 20 to 40. For example Mario is a stock analyst researching Facebook Inc. 5 5 19 votes.

The lender will either use the YTD gross income figure from your most recent payslip the gross income stated in your last group certificate or the ATO Income Statement obtained from myGov website. There are countless opportunities to be found online. 2-D Barcode Filing Filing your state paper return using a barcode.

And is based on the tax brackets of 2021 and 2022. September 2020 these results now reflect the 2019 SCF. Continue reading Income Percentile Calculator by Age.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. If your employment income is 40000 and you have rental income. The hours are part-time and.

Add up the hours of full- and part-time employees. It is mainly intended for residents of the US. The Sweden Income Tax Calculator part of.

As of June 15 2022 the Income Eligibility Calculator incorporates the FY 2022 Income Limits for all programs. The upper part of the calculator has two sections. Many people find that turning a hobby into a part-time job is like hardly working at all.

Apply to Data Entry Clerk Regional Manager Programmer and more. Be a legal resident of New York State and have resided in NYS for at least 12 continuous months prior to the start of the term. Many greeting cards flowers newspapers and other specialty items in stores are stocked by outside vendors.

This calculator estimates the tax on your rental income by using your highest personal income tax bracket. Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. For the most part individuals who stay in Malaysia for at least 182 days or more in a calendar year are considered residents for tax purposes.

All calculations that were in a users dashboard on June 15 2022 as well as calculations completed going forward will use the FY 2022. This income tax calculator can help estimate your average income tax rate and your take home pay. Income Tax Calculator for Financial Year 2008-2009.

Apart from evaluating your income you may also submit any additional proof of income. Note that extra income is only accepted by lenders if it can get funds from those sources for at least three years. Importance of Rent-to-Income Ratio why its used its benefits and its drawbacks.

This income tax applies to all employees permanent temporary full time and part time except for the employment that is not longer than 1 month. Rank your total income by age range to see what income percentile you are. Payment from overtime work.

A year to date calculator or YTD calculator is a tool used by lenders to work out your annual income from the income you earned in a part of a year. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. If you change the Cash Flow Type to Income the calculator calculates the inflation-adjusted value for the first Periodic Withdrawal Amount If you dont compensate for inflation and assuming it averages 3 over 25.

For example if we were to look at just the federal personal income tax.

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Net Profit Margin Calculator Bdc Ca

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Annual Income Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

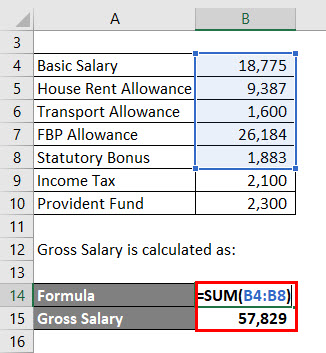

Salary Formula Calculate Salary Calculator Excel Template

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Hourly To Salary What Is My Annual Income

Annual Income Calculator

Hourly To Salary Calculator

How To Calculate Gross Income Per Month

Salary Formula Calculate Salary Calculator Excel Template

Hourly To Salary Calculator Convert Your Wages Indeed Com

Net Profit Margin Calculator Bdc Ca

Lkhjrk5ohosmhm

Overtime Calculator To Calculate Time And A Half Rate And More

Salary Formula Calculate Salary Calculator Excel Template